Running a business in the UK today means keeping a close eye on costs while staying fully compliant with financial regulations. For many companies, managing bookkeeping in-house has become both expensive and time-consuming. That’s why Bookkeeping Outsourcing to India has grown into a practical and trusted solution for UK businesses looking to reduce overhead, improve accuracy, and free up internal resources without sacrificing quality.

This article explains how bookkeeping outsourcing works, why India has become a preferred destination, and how UK companies can benefit from this approach.

What Is Bookkeeping Outsourcing?

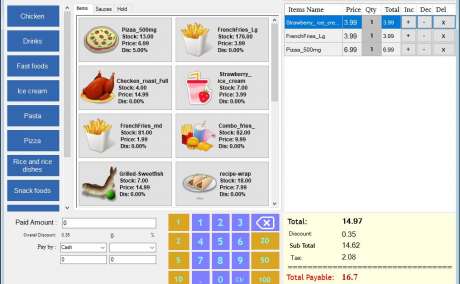

Bookkeeping outsourcing involves delegating day-to-day financial record-keeping tasks to an external service provider. Instead of hiring in-house staff, businesses work with trained professionals who manage bookkeeping remotely using secure systems and cloud-based software.

Typical bookkeeping tasks include:

-

Recording daily financial transactions

-

Bank and credit card reconciliations

-

Accounts payable and receivable

-

Invoice processing

-

Expense tracking

-

VAT-ready records

-

Monthly financial summaries

UK businesses can outsource basic bookkeeping or a full bookkeeping function depending on their needs.

Why UK Businesses Are Outsourcing Bookkeeping to India

India has become one of the leading destinations for bookkeeping outsourcing, particularly for companies based in the UK.

Cost Efficiency

One of the main reasons businesses choose India is cost savings. Bookkeeping outsourcing to India can reduce costs by 40% to 60% compared to hiring in-house staff in the UK.

Skilled Professionals

India has a large pool of trained bookkeepers and accounting professionals who are familiar with UK accounting standards, VAT requirements, and popular bookkeeping software.

Use of Modern Technology

Indian firms commonly use cloud-based tools such as Xero, QuickBooks, Sage, and secure document-sharing platforms, making collaboration smooth and efficient.

Time Zone Advantage

The time difference allows work to be completed overnight, meaning UK businesses often receive updated records by the next working day.

Common Bookkeeping Services Outsourced to India

Daily and Monthly Bookkeeping

Transaction recording ensures that financial records stay accurate and up to date.

Bank Reconciliations

Regular reconciliation helps identify discrepancies early and maintain clean accounts.

Accounts Payable and Receivable

Managing invoices, payments, and collections improves cash flow visibility.

VAT Preparation Support

Outsourced teams help prepare VAT-ready records, reducing errors and delays.

Financial Reporting

Monthly reports provide insight into income, expenses, and overall performance.

Cost of Bookkeeping Outsourcing to India

Costs vary based on transaction volume and service scope, but outsourcing remains highly affordable.

Typical Pricing for UK Businesses

-

Basic bookkeeping: £250 to £600 per month

-

Full bookkeeping services: £600 to £1,500 per month

-

Dedicated bookkeeping support: £900 to £2,500 per month

Compared to hiring an in-house bookkeeper in the UK, which can cost £30,000 or more annually, outsourcing offers significant savings.

Outsourcing vs. In-House Bookkeeping in the UK

In-House Bookkeeping

-

Higher salary and benefits costs

-

Ongoing training and software expenses

-

Limited flexibility during busy periods

Bookkeeping Outsourcing to India

-

Lower, predictable monthly costs

-

Access to a team rather than a single employee

-

Easy scaling as business grows

Outsourcing allows businesses to adjust support levels without long-term commitments.

Data Security and Compliance

Data security is a major concern when outsourcing overseas. Reputable Indian bookkeeping firms follow strict security protocols, including:

Choosing a trusted provider ensures financial data remains protected.

Who Should Consider Bookkeeping Outsourcing?

Bookkeeping outsourcing is ideal for:

-

Startups and small businesses

-

Growing SMEs

-

E-commerce businesses

-

Professional service firms

-

Business owners wanting to focus on growth

It’s especially useful for companies that need accurate records but don’t require a full-time in-house bookkeeper.

How to Choose the Right Bookkeeping Partner in India

Selecting the right outsourcing partner is essential.

Look for providers that offer:

-

Experience working with UK clients

-

Knowledge of UK VAT and accounting rules

-

Clear communication processes

-

Transparent pricing

-

Secure data handling practices

A good outsourcing partner should feel like part of your team, not an external vendor.

Real-World Example

A UK-based consultancy outsourced its monthly bookkeeping to India and cut accounting costs by over 50%. With accurate monthly reports delivered on time, the business gained better cash flow visibility and spent less time chasing paperwork.

Benefits Beyond Cost Savings

While lower costs are appealing, outsourcing bookkeeping delivers additional value:

-

Improved accuracy and consistency

-

Faster month-end reporting

-

Reduced workload for internal staff

-

Better financial visibility

-

More time for strategic planning

These benefits help businesses make better decisions and stay organised.

Potential Challenges and How to Manage Them

Some challenges may include communication gaps or onboarding time. These can be managed by:

-

Setting clear expectations

-

Using shared cloud platforms

-

Scheduling regular check-ins

Working with an experienced provider helps minimise these issues.

Final Thoughts

Bookkeeping Outsourcing to India has become a reliable and cost-effective solution for UK businesses seeking accurate financial records without high overhead costs. By outsourcing bookkeeping to skilled professionals, companies gain efficiency, flexibility, and financial clarity.

For UK businesses looking to streamline operations and focus on growth, bookkeeping outsourcing to India is not just a cost-saving option—it’s a smart long-term strategy.